- #INDEPENDENT CONTRACTOR EXPENSES FOOD HOW TO#

- #INDEPENDENT CONTRACTOR EXPENSES FOOD DRIVERS#

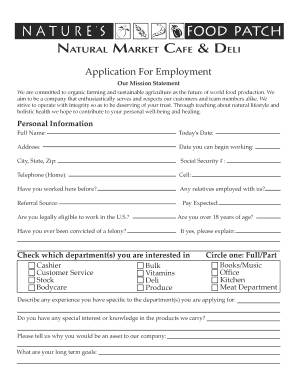

- #INDEPENDENT CONTRACTOR EXPENSES FOOD REGISTRATION#

- #INDEPENDENT CONTRACTOR EXPENSES FOOD PROFESSIONAL#

You could also use a similar app or track your mileage manually. I use the free mileage tracking app Everlance, because duh, I love free stuff.

#INDEPENDENT CONTRACTOR EXPENSES FOOD HOW TO#

How to track mileage as a delivery driver Regardless of what method you use, it is crucial that you keep track of your business mileage. The standard mileage rate is the most popular because it requires less record keeping.

#INDEPENDENT CONTRACTOR EXPENSES FOOD REGISTRATION#

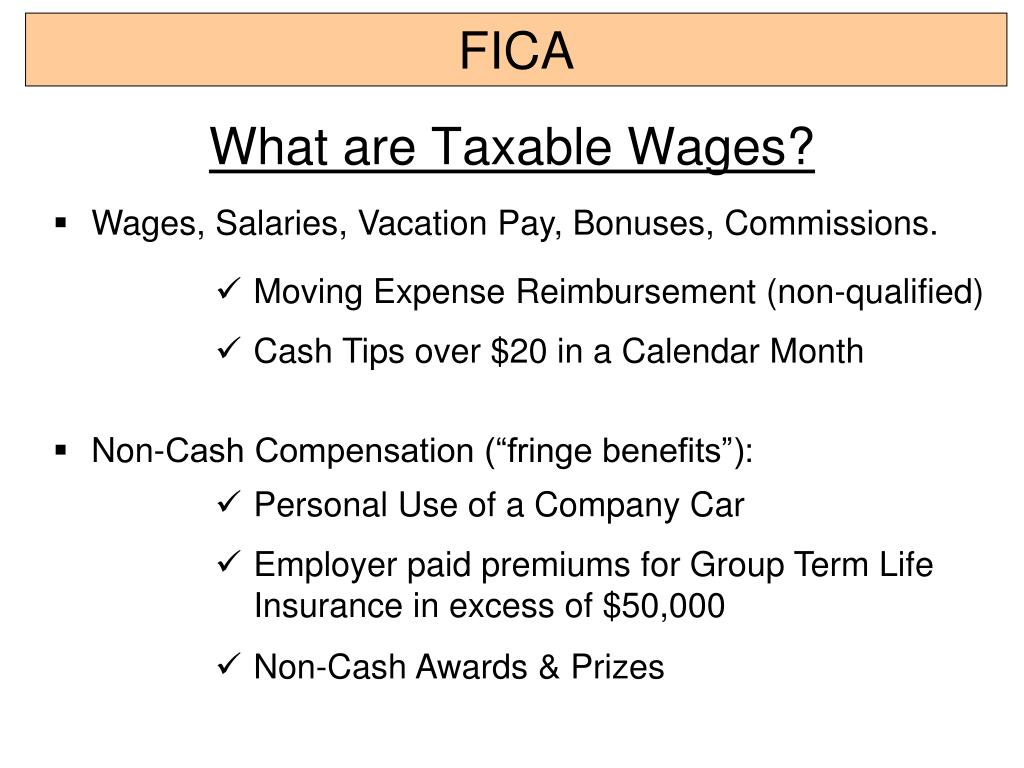

Deduct your actual car expenses like gas, repairs, depreciation, maintenance, oil, registration and more.Use the standard mileage rate of 54.5 cents per business mile you drive in 2018.You can deduct these expenses by using one of the two following methods: Your biggest deduction will be your car expenses. It’s very important for you to keep track of all the deductible expenses you incur throughout the year since they will decrease the amount of profit you’ll have to pay taxes on.

#INDEPENDENT CONTRACTOR EXPENSES FOOD DRIVERS#

What expenses can delivery drivers / independent contractors deduct? I know it may sound complicated but tax preparers and DIY tax filing systems (like TurboTax or H&R Block) will figure this out for you as well. Instead, you will file the IRS Form SE with your tax return to report and pay the self-employment taxes. The company you contract for will not pay half of them for you (employers must pay half of these taxes for their employees, but not for contractors). When you’re an independent contractor, you must pay self-employment taxes on your net income in addition to your income taxes. Great news! If you aren’t required to file an income tax return and your net earnings are less than $400, you aren’t required to report that income ( IRS reference). This is exactly why I don’t think that I’ll have to pay any taxes this year, addressed further in the deductions section below. You only pay tax on the profit you have left after you subtract all your expenses from your business income.

To show whether you have a profit or loss from your delivery business, on the Schedule C form you will list all your business income and deductible expenses. You will be required to file a Form 1040 and attach Schedule C and Schedule SE to report your income. However, if your net earnings from your contract work exceed $400, you still must report that income. This applies only if you were paid over $600 during the year. You will receive a 1099 each year from the company you contract with. Requirements for filing independent contractor taxes If you would like to SAVE money at tax time, tracking earnings and expenses could really add up. If you would like to go the easy route, it is recommended that you save 20-30% of your income for tax time, depending on your earning and tax bracket. That means that you are your own boss and will be responsible for your own taxes but you’re eligible for business-related deductions. I really wanted to make sure I understood tax law, deductions and filing requirements before I began making any income.Īs a delivery driver for Uber Eats, DoorDash, Postmates, GrubHub and more, you will be classified as an independent contractor. I heavily researched independent contractor taxes before I began my journey to become a delivery driver.

#INDEPENDENT CONTRACTOR EXPENSES FOOD PROFESSIONAL#

This post will explain exactly what I plan to do in order to make this a reality.īefore we begin, if you have any questions about your own taxes, please consult a tax professional (specific information may only apply to the US). In my previous post about how I’ve made $862 in 1.5 weeks delivering food, I closed with the fact that I expect to owe $0 in independent contractor taxes.

0 kommentar(er)

0 kommentar(er)